Nov 20-2018 Financial News! https://www.zerohedge.com/?page=1

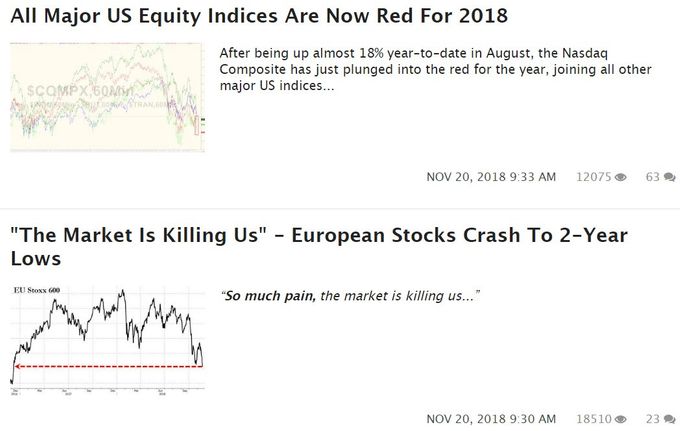

Nov 20- 2018 Markets! https://www.zerohedge.com/?page=1

Nov 19- 2018 Markets! https://www.zerohedge.com/?page=1

Nov 19-2018

Source: zerohedge.com

Whistleblower Implicates Deutsche Bank In $150 Billion Money Laundering Scandal

by Tyler Durden

Mon, 11/19/2018 - 08:58

1.4K

SHARES

Just when Deutsche Bank probably thought the worst of its legal troubles (over the Libor scandal, sales of shoddy mortgage-backed securities, FX and precious metal rigging which collective resulted in tens of billions in legal fines) were behind it, the struggling German lender is being drawn deeper into the biggest money laundering scandal in European history.

Following reports over the weekend that Deutsche, JPM and Bank of America had been approached by federal investigators about their correspondent banking business's involvement in clearing transactions for Danske Bank's Estonian branch, the whistleblower who helped blow the lid off Danske's $234 billion money laundering scandal said during testimony to the Danish Parliament that $150 billion of the money had been cleared by a large European lender, stopping short of naming Deutsche, likely to respect confidentiality rules governing the whistleblower's work at Danske. Incidentally, as Bloomberg adds citing a "person familiar", the unnamed bank is Deutsche Bank.

Deutsche continued to clear transactions for Danske's Estonia branch until 2015, two years after JPM had ended its correspondent banking relationship with Danske's Estonia branch over AML concerns. The suspicious funds flowed through Danske between 2007 and 2015 before Denmark's largest lender closed its non-resident portfolio over AML concerns.

In an internal audit released earlier this year, Danske admitted that most of the $234 billion in non-resident cash came from suspicious sources in Russia, Azerbaijan and Moldova. With the help of its dollar-clearing correspondent banks, Danske converted the rubles and other foreign currency into dollars and moved it into the Western financial system. Roughly $8 billion of the money was converted via legal-though-shady "Mirror Trades", where a client buys and sells a security in two different currencies, typically to help launder their money into dollars and euros (in a strange but sadly unsurprising coincidence, Deutsche's Moscow desk got caught up in a mirror trading scandal of its own a couple years back).

Howard Wilkinson, the former Danske employee-turned-whistleblower, claimed that some of the money flowed through a London-based trading firm called Lantana Trade, which is rumored to have ties to the family of Russian President Vladimir Putin and members of the FSB. Wilkinson is expected to testify before both the Danish and EU parliaments this week, and will also be speaking with US investigators, according to the Financial Times. In addition to the DOJ and SEC, FinCEN has said it is actively interested in the Danske case.

Wilkinson, who first warned Danske's directors in Copenhagen about suspicious activity in Estonia back in 2013 and 2014, also alluded to a "large US bank," which the Financial Times identified as JPM.

In the past, correspondent banks involved in money laundering scandals similar to Danske's have been treated as unwitting dupes by prosecutors. But the aggressive steps being taken by US prosecutors (regulators in Denmark, London, Estonia and the EU are also looking into the scandal) suggest that this could be the beginning of a crackdown that could fundamentally change how large international banks manage AML controls on their correspondent banking business.

That, in turn, could create serious problems for Baltic banks, which might find themselves effectively cut off from the broader global financial system, even if they take the necessary steps to tighten their AML controls. According to meeting minutes first reported by the FT, Danske directors acknowledged the suspicious activity in Estonia, but by April 2014, Wilkinson said it had become clear that the bank wasn't planning to act. Indeed, former Danske CEO Thomas Borgen, who had previously run the bank's international business, had reportedly taken steps to protect the Estonian branch, which Danske took over during its acquisition of Finnish Sampo Bank.

We'll give you one guess as to why:

1 day ago

The world will become a much better place when all banks are shut down. The world's money system has been shown to have failed the vast majority of humanity, and has only served a relative small number of global criminals. Real capitalism no longer exists and has been subject to manipulation for years. As Lord Acton stated in 1887, "Power corrupts, and absolute power corrupts absolutely". The Bankers have managed to ruin our world, and the time has come for them to leave.

-

1 day ago

Banks and government colluding to steal from shareholders, customers

and employees... to enrich executives and government. How progressive!!!!

-

1 day ago

Douche Bank again eh? No surprises here.....

Another sickening story of corruption and crime that will result in zero arrests or maybe a fuckin' paltry fine.

Obviously another story of 'The Far Too Well Connected & Protected To Prosecute...'

I know I am not alone when I say my patience has now been stretched beyond any reasonable limit when it comes to prosecuting or even investigating this crooked scamming bankster scum and filth who are ******* the whole planet up for profit.

Estonia is a hacker's paradise,it's a real damned shame that more of the Black Hats don't move on these fuckers locally.

-

1 day ago

In the words of Robert Mueller - "follow the money".... and the true crime of the Clinton Foundation will be revealed.

-

1 day ago

Yeah, the lowest tax rates ever in the history of the USA are really causing all this theft, spoken by the true fan of the vampire squid banking system.

How about some re-regulation of consumer banks, so they don't get to gamble 24-7?

Besides, this is about Russia oligarchs and Putin washing their worthless rubloids into real money that can be used in real countries for real fun and purchases, including American real estate, since we let our own citizens suffer while our rich boy developers like Donald Dump take the crooked money for overpriced real estate. Ya think maybe taxes should be higher on foreign real estate purchasers, since they're essentially criminals? Of course you don't...it's all the socialists living in their parent's basements that are to blame.

-

1 day ago

All digitally based attempts at currency are 100% evil constructs which are ponzi based scam time-bombs.

The same can be said about any derivatives.

If you can't physically hold it in your hands, it is NOT REAL.

Additionally: If you don't physically hold it in your hands, you do NOT OWN it.

-

1 day ago

And the crimes keep coming, aided by conflicted regulators who protect their former and future employers. Jail every involved bankster and strip them of all their assets with 3x penalties.

Until the penalties far exceed the potential gains, laws will be skirted and the public swindled.

As for the worthless Fed. Their alleged charter of low inflation and high employment have been discredited for decades. Time to evict these pompous asses from their lofty throne and restore control of our money to the government, preferably under a gold backed system.

As for the regulators, it is time they either choose a career in public service or one in banking. Any current 'experience' they bring from the banking world is clearly not in the public interest.

-

1 day ago

#BankstersAreTheRealTerrorists - Banks, NOT Nations, enjoy Sovereign-like monopoly to "loan" money they do not have to people, to business, to nations, with interest (usury). Now, after many generations of this, the parasite

banksters have literally bought the entire world's resources. Banksters actually OWN the entire world (monopoly)

( http://arxiv.org/PS_cache/arxiv/pdf/1107/1107.5728v2.pdf )

remember when HSBC got "caught"? but then the BiS intervened in the US Justice System? lol. and the "fines" became NOTHINg but a trivial cost of doing god's business?

this is a really good documentary exposing the lawlessness of Banking, and the joke..of US, or any other nation's sovereignty when it comes to banks. recall, the BiS is IMMUNE to all international laws.

All The Plenary's Men https://youtu.be/2gK3s5j7PgA

haven't we seen reports that something akin to over $800 Billion annually of drug and terrorist money is laundered through the "markets"?

-

1 day ago

There is no truth to the rumor that this is American military black budget laundering. Not at all.

Oh look, a Russian !

KAKO PODESITI DA SE DOBIJE PREVOD YOUTUBE FILMOVA

#1.

Kratak kurs sadasnjih globalnih finansijski zbivanja!

a. What use is money if you don't have freedom?

b. Whta is the monetary matrix ?

c. Fiat currency, why it so important to our freedom.

d. The quality of a society is directly proportional to the quality of its money. Debase a currency for long enough, and you end up with dangerous deficits, debt driven disasters, and eventually...delusional dictators. History proves this to be true.

1. #1/#7 Money vs Currency - Hidden Secrets Of Money Ep 1 - Mike Maloney

https://www.youtube.com/watch?v=DyV0OfU3-FU

2. #2/#7 Seven Stages Of Empire - Hidden Secrets Of Money Ep 2 - Mike Maloney

https://www.youtube.com/watch?v=EdSq5H7awi8

3. #3/#7 Death Of US Dollar Reserve Status - Hidden Secrets Of Money Ep 3- Mike Maloney

https://www.youtube.com/watch?v=y-IemeM-Ado&list=PLE88E9ICdipidHkTehs1VbFzgwrq1jkUJ&index=3

4. #4/#7 The Biggest Scam In The History Of Mankind - Who Owns The Federal Reserve? Hidden Secrets of Money 4

https://www.youtube.com/watch?v=iFDe5kUUyT0&index=4&list=PLE88E9ICdipidHkTehs1VbFzgwrq1jkUJ

5. #5/#7 Rise Of Hitler Was ECONOMICS - Hidden Secrets Of Money Ep 5 - Mike Maloney

https://www.youtube.com/watch?v=OQWMd_NPSBA

6. T#6/#7 op 4 Reasons For Deflation - Hidden Secrets Of Money 6 (Mike Maloney)

https://www.youtube.com/watch?v=8GP87dgTqF8

7. #7/#7 End Of USA Dominance - Death Of The Dollar Update - Mike Maloney

https://www.youtube.com/watch?v=OgNb83Y0CoY

1-8. Mike Maloney Schools Bankers on Deflation, Oil Price Crash, Gold and Silver (Part 1 of 2)

https://www.youtube.com/watch?v=uzef43gdupk&list=PLE88E9ICdiphexE6OmEo3mKx-PenE_pux

1-9. Mike Maloney Schools Bankers on Deflation, Oil Price Crash, Gold and Silver(PART 2!)

https://www.youtube.com/watch?v=0Wrrzsrb-wg&index=2&list=PLE88E9ICdiphexE6OmEo3mKx-PenE_pux

1-10. Mike Maloney - Coming Deflation Will Kill Real Estate Investors

https://www.youtube.com/watch?v=lTxQ-oO7V0c&list=PLE88E9ICdiphexE6OmEo3mKx-PenE_pux&index=24

1-11. The Case For Short Term Deflation - Mike Maloney of Gold & Silver Inc

https://www.youtube.com/watch?v=QkSJxVTgles&index=4&list=PLE88E9ICdiphexE6OmEo3mKx-PenE_pux

1-12. Mike Maloney - Playlist compilation

https://www.youtube.com/watch?v=1CF93-sxYqA&index=3&list=PLE88E9ICdiphexE6OmEo3mKx-PenE_pux

1- #1/#7-Money vs Currency - Hidden Secrets Of Money Ep 1 - Mike Maloney

Published on Feb 26, 2013

More: http://HiddenSecretsofMoney.com Currency vs. Money is the 1st Episode /# 7, of Mike Maloney's Hidden Secrets of Money, a series presented by Mike Maloney as he travels the world to uncover the Hidden Secrets of Money.

#2.

Heres-where-next-bank-deposit-bail-will-strike..

Unfortunately, public health is not immune from money movements on the market. Therefore “here” you will find economic and political information on trends that have the capacity to influence your savings, your retirement, and your access to local/worldwide health systems. It is a “deduce yourself” page of what to anticipate and how to position yourself to upcoming events.

by Tyler Durden

Oct 10, 2016 2:00 AM

One shot from a pistol pierced the night right before Antonio Bedin collapsed, dead.

Antonio, a 67 year-old retired Italian, had just committed suicide. He was plagued by health problems and by the loss of his savings.

Last year, four small Italian banks became insolvent and immediately needed capital. They turned to a bail-in.

Antonio was one of thousands of small savers who were wiped out. Antonio lost everything. Then he shot himself.

He wasn’t alone.

There was another pensioner who hung himself at his home near Rome after he lost more than $100,000.

Their stories became national news sensations. It generated intense anger at the bail-ins.

A bail-in is when a bank recapitalizes itself by tapping its creditors, including depositors.

Most people think of the money they deposit into the bank as a personal asset they own.

But that’s not true.

Once a deposit is made at the bank, it’s no longer your property. It’s the bank’s. What you own is a promise from the bank to repay. It’s an unsecured liability. That’s a very different thing from owning physical cash stuffed under your mattress. Money deposited into the bank technically makes you a creditor of the bank. You’re liable to get burned from a bail-in should the bank get into trouble.

People in Cyprus had to find this out the hard way in early 2013. People awoke on an otherwise normal Saturday morning to the shock that the money in their bank accounts had been taken by a bail-in to recapitalize the banks.

Not surprisingly, many Italians aren’t just waiting around to get “Cyprused.”

I recently spent weeks on the ground in Italy investigating the ongoing banking crisis. I spoke with a prominent lawyer who told me that most Italians are now distrustful of the banks. They’re keeping a substantial portion of their savings in cash under their mattresses. They’re also buying lots of gold.

I’ve been to Italy numerous times over the years. But this time, I saw something new. There were signs everywhere advertising gold bullion, like the one below.

I think it indicates a strong demand for gold and a strong distrust of the banks. It seems to me like a slow motion bank run is already happening. This is the last thing Italy’s banking system needs. It’s further bleeding the capital in the banking system.

I only see the situation getting worse…

Italians are rightly afraid of bail-ins. That fear is leading them to withdraw their savings as cash and also to buy gold. This further drains the banks’ capital, making it more likely they’ll need to do a bail-in to remain solvent, which fuels even more withdrawals. It’s like a self-fulfilling prophecy.

This means that the chances are good that a large number of unsuspecting Italian savers are going to get wiped out.

The thought of potentially many more old, struggling pensioners committing suicide because they got wiped out from bail-ins has enormous emotional power in Italy. It’s like political nitroglycerin.

It would have a catalyzing political effect.

Bottom line, if Italians get Cyprused before the referendum later this year it’s a virtual certainty it will fail.

That’s the unenviable conundrum the current, pro-EU Italian government is facing. They can stall and save the banks through a bail-in, or they can let the whole house of cards come down. Either option is political suicide.

It’s hard to imagine that the frustrated Italian populace won’t vote to give the establishment the finger in the referendum, and humiliate the pro-EU government.

Prime Minister Matteo Renzi has promised to resign if that happens.

If he does, the anti-euro, populist Five Star Movement will almost certainly come to power. They’ve promised to promptly hold another referendum. This one would be on whether Italy should leave the euro and go back to its old currency, the lira.

If Italy—the third-largest member of the eurozone—leaves, it will have the psychological effect of someone yelling “Fire!” in a crowded theater. Other countries will quickly head for the exit, and return to their national currencies.

Economic ties and integration are what hold the EU together. Think of the currency as the economic glue. Without the euro, economic ties will weaken, and the whole project could unravel.

It would be a deathblow to the EU, the world’s largest economy… And it would explode into a global stock market crash like the world has never seen.

The Financial Times recently put it this way:

That’s how important the upcoming referendum in Italy is. It would be the first domino to fall in the collapse of the EU.

Not surprisingly, the unsavory George Soros is keenly aware of what’s going on. He recently said, in reference to the Brexit and events in Italy, “Now the catastrophic scenario that many feared has materialized, making the disintegration of the EU practically irreversible.”

Soros Fund Management has been picking up gold assets and placing bets that stocks will crash.

He’s positioning to make big profits from the coming crisis. And I think we should, too.

That’s exactly why I recently spent weeks on the ground in Italy.

There are potentially severe consequences in the currency and stock markets.

38BWD22 Oct 10, 2016 2:23 AM

Some comments:

In 2012 we were in Italy on vacation. I remember seeing all these signs advertising "Compro Oro" (pawn shops advertising to buy people's gold) in various cities: Rome, Caserta, Lecce, Bari, Taranto... I wrote a couple of blog pieces about it with pictures.

Now Italians want to buy gold? Things must be even worse there than in 2012.

* * *

Might we see similar signs here in America if our economy falls down again...?

Cliff Claven Cheers 38BWD22 Oct 10, 2016 2:34 AM

I could be

wrong but I think Soros might be carried out on a strecher, the days of bond vigilantes is dead int he new Central Bank bail out era. Never under estimate a good printing press run to keep the zombies alive a few more years.

darteaus Cliff Claven

Cheers Oct 10, 2016 3:25 AM

The reason Soros is so prominent is 1) He's a raging egotist, and 2) He's being set up as the fall guy, i.e. there are many more guys like him who don't mind him being the face.

mkkby darteaus Oct 10, 2016 4:04 AM

Bullshit article. There was NO Italian bail in. The guy who committed suicide was a stock investor. It was his own fault for putting all his eggs in one rotten basket. When a business goes under, the stock and bond investors deserve their fate. They WILLINGLY

CHOSE the risk.

Italy has a 100k euro deposit insurance limit. If they ever resort to bail ins, all you have to do is keep your account under 100k and you will be fine.

Why can't international man (i.e Simon fucking black) ever tell the truth? Is

this shit company a Clinton property?

sessinpo mkkby Oct 10, 2016 7:27 AM

Yea, I think you are correct. Some got a bail out, not in bail in.

However, I find it curious that anyone would actually rely and believe in depositor insurance.

Simply put, you can't trust any of these institutions including the bank, the insurer or the government.

philo24 mkkby Oct 10, 2016 7:43 AM

I'm Italian and i agree with mkkby, in the article there are few mistakes:

It wasn't about

bank deposit, but about bank's high risky bond

Italiy has 100k euro deposit limit insurance

These banks sold their bonds to old people without any financial knowledge, in some cases the banks fakes their clients signature and their financial

knowledge declarations. So was actually a FRAUD.

Yes in 2012 there were a lot of "Compro Oro" (Buy Gold) shops.

The reasons were 2:

1) The price of gold was skyrocketing

2) Italy was (And still is) in recession/stagnation, a

lot of poor people who needed cash sold the gold stuff that they've got at home.

A lot of those shop now are closed.

The advertising about Gold in the picture, or anothore one i've listened on the italian major Business Radio that was

about "Buy True Gold Roman Coins" as an Investment.

The reason is simple:

We (italians) don't fucking kwnow where to invest our money.

The "classic" investing Markets for the italian are at 0% yeld

- Real estate price

are declining, and renting the last years became dangerous

- Bond Italian Market is almost 0% yeld

- Bank deposit are at 0% yeld (or less)

So 0%reward/ high risk

The perception of gold for avarage italian investor is as riskless commodity

philo24 mkkby Oct 10, 2016 7:44 AM

yep

Flankspeed60 mkkby Oct 10, 2016 10:31 AM

........all you have to do is keep your account under 100k and you will be fine.

Seriously? If one or two banks go down, maybe. But in a general

meltdown scenario, NO backup system anywhere can cover even 1% of the potential depositor liabilities. In the US, FDIC is a fraudulent charade.

Nobodys Home darteaus Oct 10, 2016 5:47 AM

Soros is a rothschild minion....not sure why you were

downvoted...except he's not a fall guy....the rest I agree with.

Nemontel darteaus Oct 10, 2016 6:16 AM

Soros is a degenerate Leftoid Globalist. http://www.truthjustice.net/politics/the-cuckening/

CCanuck 38BWD22 Oct 10, 2016 2:46

AM

+ 1 DoChen,

Have you noticed the same signs in other cities you have travelled to since 2008?

I have seen them in every city in U.S and Canada I've been in.

I have a banner right now on this page advertising buy/sell gold from a local

shop, in Edmonton, population around 1,000,000

jonjon831983 CCanuck Oct 10, 2016 3:05 AM

If you see gold banners now it might be due to you searching for gold on Google.

Ads are based on your search history.

CCanuck jonjon831983

Oct 10, 2016 3:29 AM

I know that my ad search reflects what I see,

However i see physical signs all over the city, every mall has buy/sell gold shops and kiosks.

I am just looking for others experience based on international cities.

As

I don't trust most reported stats, the word on the street can be used to confirm reports.

Keep stacking!

Ccanuck

buzzkillb 38BWD22 Oct 10, 2016 2:43 AM

We were in Naples about 3 years ago and everything handed to us as tourists said

we would be robbed while walking around. I have never seen anything like that, and we have been to some sketchy countries.

zvzzt 38BWD22 Oct 10, 2016 4:07 AM

In (most of) Europe, gold is less of a dirty word than in the US.

ProsperD9

zvzzt Oct 10, 2016 4:49 AM

You are 10000% correct....I easily buy gold here and the bank doesn't flinch an eye. No signing papers, no showing ID, just hand over the cash...LOL

ProsperD9 38BWD22 Oct 10, 2016 4:51 AM

The economy has already

fallen....again! They are good at trying to cover it up; however, those in the know see the signs everywhere and act accordingly.

Nobodys Home 38BWD22 Oct 10, 2016 5:40 AM

Do.....I live in NH....in a small town there are 3 metals buyers...One

of these days I'm going to ask if they sell........I checked out a pawn shop a while ago.....they had a 10oz sunshine bar for....$200!!!! It was worth about $160 back then...assholes

doctor10 38BWD22 Oct 10, 2016 6:35 AM

more currencies makes

so much sense. It basically is spreading the risk

The world's oligarchs have an adolescent pre-occupation with centralized control-so very 19-30th centurys

The 21st century is waiting for the market to wipe out legacy 19th-20th century institutions

so it can get started

New_Meat 38BWD22 Oct 10, 2016 8:53 AM

we get to see both pawn shop buying and shills selling the precious on TeeVee every night.

- Ned

{Nice rollers u got there, fella'}

myne Oct 10, 2016 2:15 AM

How does one get euro denominated debt? I figure borrowing at the right time and using the loan to pay the loan should leave a decent chunk left when you can buy 100eu notes for the cents to pay it back.

Lost in translation Oct 10, 2016

2:27 AM

Senior citizens suiciding themselves on account of bankster theft is an outrage and a tragedy. It's the bankers who should die, not the pensioner.

Cliff Claven Cheers Lost in translation Oct 10, 2016 2:35 AM

in a just world my

friend that would be true.

Nobodys Home Cliff Claven Cheers Oct 10, 2016 5:33 AM

Yah bahstad...weah ah u frum? Now get youa shit togetha an have sum balls you mutha fucka. Cliff Claven my ass!

just kidding..

holgerdanske Lost

in translation Oct 10, 2016 2:59 AM

"Senior citizens suiciding themselves on account of bankster theft is an outrage and a tragedy. It's the bankers who should die, not the pensioner"

Just give it some time!

hendrik1730 Lost in translation

Oct 10, 2016 3:21 AM

If I were in such pensioners' position, I would not take MY life but a banksters one. Or as much as possible before they stop me. And then they can put me in jail and take care of me for the rest of my days. When only 10 ( ten ) pensioners

would do this, bail-ins would very quickly stop. ( and be follewed by hyperinflation, plan B )

sinbad2 hendrik1730 Oct 10, 2016 3:32 AM

But you can't get at them, you could kill a teller, but he is as much a victim as you.

The boss arrives

on the roof, in a chopper, Blankfiend has probably never seen the entrance of GoldinSacks.

zvzzt sinbad2 Oct 10, 2016 4:35 AM

To be (somewhat fair), most bankers just exploit / "excessively use" the framework spread out for them by the politicians.

If I got a government guarantee to get my money back when entering a casino, I'm not going to be playing morally correct for too long either.

Long rope for three parties: politicians, bankers and their lobbyists.

RaceToTheBottom

zvzzt Oct 10, 2016 8:39 AM

I am good with short rope, as long as it holds. Squirming while asphyxiating is fine with me.

Nobodys Home sinbad2 Oct 10, 2016 4:54 AM

I asked the manager of the bank i hatefully need to use if she had

any knowledge of the shit going down with Deutchbank...None!

She told me she doesn't listen to the news.

I asked her if she knew what happened in Cyprus....nope

Greece...nope

They know me at this bank. They ask me if my mattress is full

yet

They ask me that because they used to ask me about my pillows.

My advice......find a local bank or whatever....and don't leave your cash in it...especially over long weekends!

Wallyroo Nobodys Home Oct 10, 2016 10:31 AM

I am also

a regretful bank minion. When my paycheck hits I am no longer a creditor. I always leave less than 10.00 in my account. It's my money, not theirs.

VWAndy Oct 10, 2016 2:58 AM

Some great store of wealth they had. Overnight a 0 poof!

quasi_verbatim Oct 10, 2016 3:18 AM

They got you every which way.

Stuff your cash under the mattress -- they change the currency overnight, ban the old cash.

Stackers will be SWATted and shot.

We have a new plastic £5 note with

a picture of Winston on it. Big fucking deal. It'll just about buy you a Starbucks.

When Winnie was Prime Minister you could live well on £5 for a month.

RayKu quasi_verbatim Oct 10, 2016 4:11 AM

I'm not convinced most people get

that. Currency can be wiped out overnight, PM stacking is all well and good, but how is a person going to convert it when they need it to buy food or other essentials? What do they do when government agencies outlaw it? Maybe they should be stacking cans of

food first.

Nobodys Home RayKu Oct 10, 2016 4:34 AM

Buy food...canned food lasts about forever! Screw the dates on the can. If it's not looking strange it's edible. Unless it smells bad when you open it...and even then it might be ok. Have

you heard what Germany said? 10 days of food and water?

10 days? Most people can't go 3 days in the US...even if they have a baby. I've been planning for 10 people for 2 years, buying sales and bulk and ammo.

I have found amazing deals...been doing

it for a while...I pay 1/2......I;m also a fucking asshole that will kill you as soon as you open your mouth

Ignorance is bliss RayKu Oct 10, 2016 9:47 AM

Look into "gold money"

I don't recommend putting all your savings into a gold money

account, but think it's a good way to retain liquidity and to diversify. It allows you to redeem your gold in pounds, dollars, Euros, and another currency which I don't recall as you need it.

Bemused Observer RayKu Oct 10, 2016 10:07 AM

People

stack because they realize that although having the 'stuff' (canned goods, water, etc) is desireable, they also understand that STORING enough of it to get you through even a few months is problematic. It also means you are now tied to the physical place...

The stacker can grab his stash and move it much more easily. As for trading? Well, I suppose THAT could be problematic as well, but the history tells me this is unlikely, as every time a fiat currency died, PM's quickly filled the void, regardless of what

the various powers wanted and demanded of people. Their wishes simply did not matter once their fiat died.

And all of those nations and empires? They are now gone, swept into history's dustbin, along with their worthless currencies. I'll bet they never

saw it coming, either. Just like today.

Nobodys Home quasi_verbatim Oct 10, 2016 5:19 AM

Apparently you and Rayku.....don't have a concept of using the black/grey market.....

JailBanksters Oct 10, 2016 3:33 AM

Who says Bail-ins

don't work.

The Bank lives on ... well, until the next Bail-in

Nobodys Home JailBanksters Oct 10, 2016 4:12 AM

You paid for the last one. Ready to do it again?

JailBanksters Nobodys Home Oct 10, 2016 5:46 AM

As one

leaves the Criminal Banking System another one joins. Sooner or Later every new born is forced into the Criminal Banking System or you can't get paid.

GoldIsMoney Oct 10, 2016 4:20 AM

"Antonio was one of thousands of small savers who were wiped

out. Antonio lost everything. Then he shot himself."

It's time to get that right. If you open an account with any bank the money you put there is a credit to the bank.

So if they do not know that, they're toast. Since ages do I criitize that.

But what do I hear - oh the pooe savers. F.... they yre not poor they are creditors and credits to get lost. That's the simple fact. So instead of crying about the poor savers I suggest working to get that theft proseuted. Now here's the easy deal.

Let

ther be saving accound and this are exactly that. Account for savings, they won't get lend they won't get a credit for the bank. If any ideot wants some interest, then he can get it but don't wine if the bank defaults on that debt.

Ignorance

is bliss Nobodys Home Oct 10, 2016 9:43 AM

Let's see how they feel once their savings are stolen. I bet they are the first to lock and load then.

Nobodys Home GoldIsMoney Oct 10, 2016 5:15 AM

Yup...Except they used to be depositors...now

they're creditors....when the bank loses everybody loses now......fuckers!

http://www.zerohedge.com/news/2016-10-10/heres-where-next-bank-deposit-bail-will-strike

Discalimer - FAIR USE NOTICE: These pages/video may contain copyrighted (© ) material the use of which has not always been specifically authorized by the copyright owner. Such material is made available to advance understanding of ecological, POLITICAL, HUMAN RIGHTS, economic, DEMOCRACY, scientific, MORAL, ETHICAL, and SOCIAL JUSTICE ISSUES, etc. It is believed that this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, this material is distributed without profit to those who have expressed a prior general interest in receiving similar information for research and educational.

Share this page